Finding reliable hotel suppliers in China feels overwhelming. Thousands of manufacturers claim to offer quality products. Prices vary wildly. Communication barriers slow everything down. And one bad supplier choice can derail your entire hotel opening.

We’re Hotemax, a Shenzhen-based supplier specializing in hotel textiles and amenities. We’ve worked in China’s hotel supply industry for years. We know which suppliers deliver consistent quality. We understand the challenges international buyers face.

This guide shares what we’ve learned. You’ll discover 10 leading Chinese suppliers serving global hotel projects. Each company brings different strengths. Some excel at custom furniture. Others specialize in sustainable textiles. A few offer complete procurement services.

More importantly, you’ll learn how to evaluate suppliers effectively. We’ll show you which certifications actually matter. You’ll see real cost breakdowns including shipping and tariffs. You’ll understand common mistakes that waste time and money.

China supplies 60% of global hotel FF&E. The country exported over $5 billion in hotel supplies in 2024 alone. These numbers tell you why buyers keep returning to Chinese manufacturers despite the challenges.

Let’s start with the suppliers, then explore why China dominates this market and how to source successfully.

10 Leading Hotel Suppliers in China

We selected these suppliers based on export volume, international client portfolios, and verified track records. They represent different specialties across furniture, textiles, and amenities. We included ourselves (Hotemax) because we genuinely belong in this conversation for textile sourcing.

Note: These aren’t ranked by size or quality. Each serves different needs. Your best choice depends on what you’re sourcing and your specific requirements.

Hotemax (Shenzhen Guanghengda Technology)

Our specialty: Hotel textiles, linens, slippers, and bath amenities

We operate from Shenzhen focusing exclusively on hospitality textiles. Our product range covers bed linens, bath towels, bathrobes, slippers, and guest toiletries. We serve hotels across North America, Europe, and the Middle East.

Why we’re different: We handle both textiles and amenities from one facility. You can order 300-thread-count sheets, embroidered towels, and branded shampoo bottles in a single order. This integration simplifies vendor management and consolidates shipping.

We maintain OEKO-TEX certifications for our textiles. Our MOQs start at 500 pieces for standard white linens. Custom embroidery or colors require 1,000+ pieces. Lead times run 4-6 weeks for standard products, 8-10 weeks for full customization.

Best for: Hotels wanting integrated textile and amenity sourcing with sustainability certifications

Honest assessment: We’re not the largest textile supplier in China. But our integrated approach works well for buyers who want one vendor handling multiple textile categories. Our English-speaking team makes communication straightforward for Western buyers.

Yabo Furniture

Specialty: Luxury custom hotel furniture

Yabo dominates the luxury hotel furniture segment. They’ve operated for 20+ years supplying brands like Ritz-Carlton and Marriott. Their 50,000 square meter factory produces complete FF&E from bedroom suites to restaurant seating.

Why they’re different: Few Chinese suppliers match Yabo’s design capabilities for high-end properties. Their 3D rendering service lets you visualize furniture in your space before production starts. This prevents costly design mistakes.

They hold ISO 9001 and FSC certifications. MOQs start at 50 room sets. Expect to pay $800-$2,500 per room depending on materials and complexity. Lead times run 8-12 weeks from final design approval.

Best for: Four-star and five-star properties needing custom furniture that matches specific design aesthetics

Watch for: Higher price points than mid-market suppliers. Yabo targets luxury projects, not budget properties.

JETWAY Hotel Amenities Manufacturer

Specialty: OEM/ODM guest toiletries

JETWAY started in 2001 and grew into China’s largest dedicated amenity producer. They manufacture everything from shampoo to dental kits with GMPC-certified facilities1.

Why they’re different: Complete amenity program development. They’ll create custom formulations, design bottles, develop scents, and handle all regulatory compliance documentation. Few suppliers offer this end-to-end capability.

MOQs run 5,000 units for standard formulas, 10,000 units for custom development. Pricing ranges from $0.40 to $1.80 per unit depending on size and ingredients. They offer biodegradable packaging options. Lead times average 6-8 weeks.

Best for: Hotel chains building branded amenity programs from scratch

Watch for: Higher MOQs than smaller amenity suppliers. Not ideal for boutique hotels needing under 5,000 units.

Sunon Furniture Group

Specialty: Sustainable hotel furniture

Sunon built their reputation on environmental responsibility. They source FSC-certified wood2 exclusively. They use water-based finishes. Their designs balance aesthetics with durability for commercial use.

Why they’re different: Comprehensive LEED documentation. Most Chinese furniture suppliers can’t provide the material declarations and VOC testing results that LEED-certified projects require. Sunon maintains these documents systematically.

They serve primarily five-star properties. MOQs start at 30-50 sets. Pricing runs $600-$1,800 per room. Lead times are faster than most luxury suppliers at 6-8 weeks.

Best for: New hotel developments pursuing LEED certification

Watch for: Premium pricing reflects sustainability certifications. Budget properties may find costs prohibitive.

Shanghai JS Sourcing

Specialty: Hospitality procurement management

JS Sourcing operates differently than manufacturers. They’re a sourcing specialist coordinating products from multiple factories. They handle logistics, quality inspections, and vendor management.

Why they’re different: Single point of contact for complete hotel openings. They’ll source furniture from Foshan, linens from Yangzhou, and amenities from Guangzhou. Then coordinate everything into consolidated shipments.

They’ve operated since 2011 supporting luxury resorts and international chains. No standard MOQs since they source from various manufacturers. They charge 8-15% service fees on total order value. Lead times vary but typically run 10-16 weeks for complete projects.

Best for: New hotel openings needing 100+ rooms fully furnished

Watch for: Service fees add costs. Only makes sense for large projects where coordination value exceeds the fee.

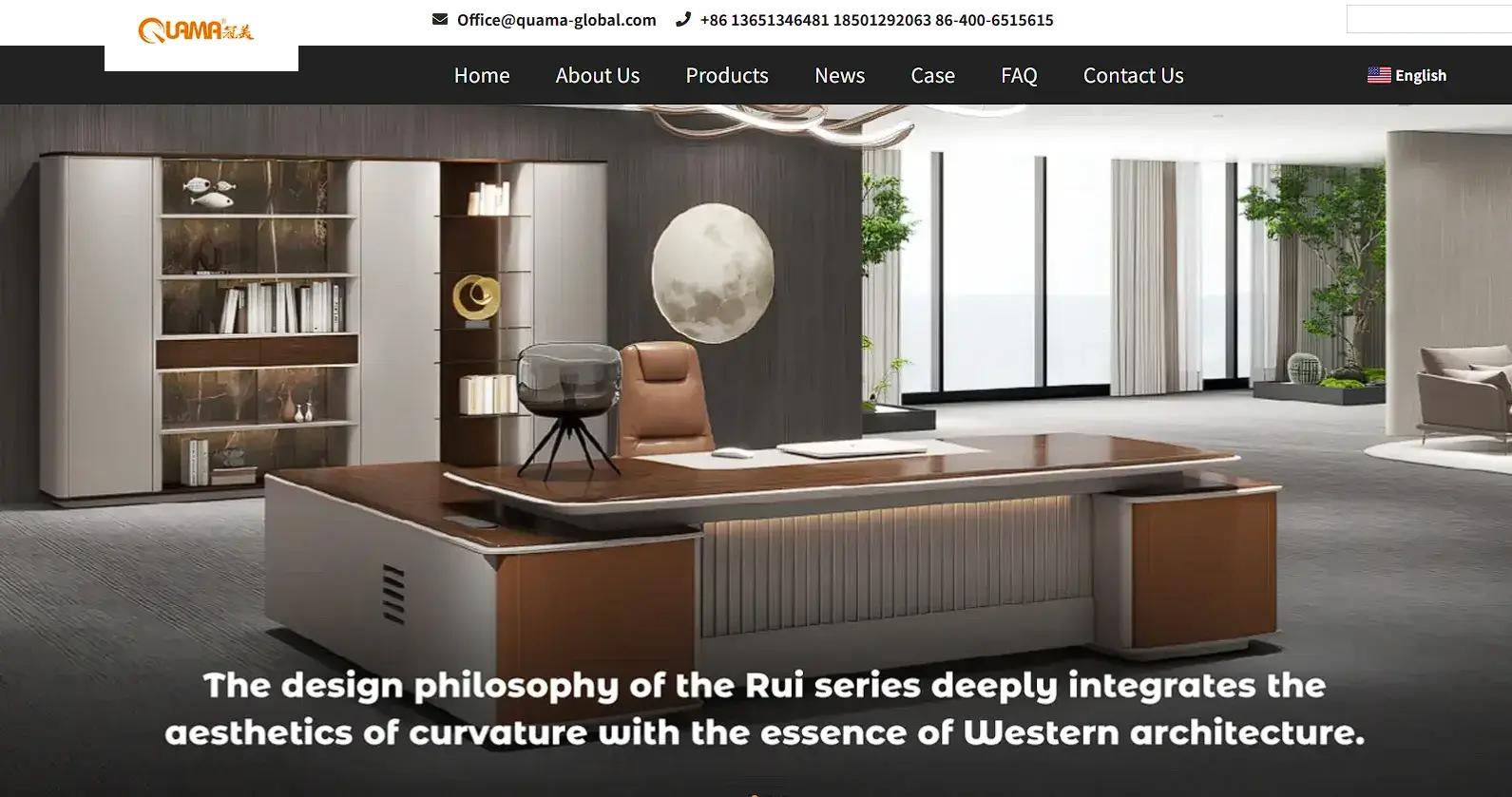

Quama Furniture

Specialty: European-style wood and metal furniture

Quama targets upscale European markets with 60% of production exported to EU countries. They excel at fine wood craftsmanship combined with modern metal accents.

Why they’re different: CARB Phase 2 certification3 for formaldehyde emissions. This certification is legally required for California and EU sales. Most Chinese furniture suppliers lack this certification and cannot legally sell in these markets.

They offer 3D design tools and work with solid wood species including oak, walnut, and teak. MOQs start at 20 complete room sets. Pricing ranges from $1,000 to $3,000 per room. Lead times run 10-14 weeks.

Best for: US West Coast and European properties requiring CARB compliance

Watch for: Premium pricing reflects EU compliance costs. Design aesthetic skews traditional European rather than modern minimalist.

Richang Furniture Group

Specialty: Complete mid-market room packages

Richang serves the three-star to four-star segment with complete guestroom packages. They supply Accor properties and similar chains. One order includes bed, nightstands, desk, chair, luggage rack, and wardrobe.

Why they’re different: Installation teams for large projects. They send technicians for projects exceeding 200 rooms. This service reduces local labor costs and prevents assembly errors that delay openings.

Production capacity reaches 500 room sets monthly. MOQs start at 50 complete rooms. Pricing runs $500-$1,200 per room. Lead times are 8-10 weeks.

Best for: Mid-market chains opening multiple properties annually

Watch for: Design options are more limited than luxury suppliers. Focus is efficiency and reliability over custom aesthetics.

Galaxy Hospitality

Specialty: High-volume textile production

Galaxy operates a 40,000 square meter textile facility producing over 1 million pieces monthly. They specialize in sheets, towels, and bathrobes for hotel chains.

Why they’re different: Production scale enables 3-4 week rush delivery. When other suppliers quote 6-8 weeks, Galaxy can expedite for urgent hotel openings.

They hold OEKO-TEX Standard 100 certification4. MOQs run 500 pieces for standard white products, 1,000-2,000 pieces for custom colors or embroidery. Pricing ranges from $3 to $15 per piece depending on specifications.

Best for: Large chains needing fast turnaround on high-volume orders

Watch for: Less flexibility on customization than smaller suppliers. Their strength is volume production of standard specifications.

Guangzhou Besteasy Hotel Supplies

Specialty: One-stop hotel supply sourcing

Besteasy offers over 3,000 SKUs spanning linens, amenities, and public area items like waste bins and luggage carts. Their Guangzhou facility integrates multiple product categories.

Why they’re different: Shortest shipping times to Southeast Asian markets due to Guangzhou port location. For Singapore, Bangkok, or Manila projects, they offer significant shipping time advantages.

They maintain 4.6/5 star ratings on Alibaba with trade assurance protection. MOQs start at 300 pieces for most items. Lead times average 5-7 weeks.

Best for: Southeast Asian hotel projects needing multiple product categories

Watch for: Product quality suits three-star to four-star properties. Luxury properties may need more premium suppliers.

Jiangsu Leju Cosmetics

Specialty: Low-MOQ toiletries

Leju focuses exclusively on hotel toiletries with over 200 formulations available. They manufacture shower gel, shampoo, conditioner, body lotion, and hand soap.

Why they’re different: MOQs starting at 3,000 units. Industry standard runs 10,000+ units from larger suppliers. This accessibility helps boutique hotels and smaller chains afford custom amenity programs.

They hold ISO 22716 (GMP for cosmetics) certification. Pricing ranges from $0.35 to $1.50 per unit. They source eco-friendly packaging options. Lead times run 6-8 weeks.

Best for: Boutique hotels (20-50 rooms) wanting branded amenities without massive order quantities

Watch for: Limited production capacity means less ability to scale if your hotel chain grows rapidly.

Why China Dominates Hotel Supply Manufacturing

Understanding China’s advantages helps you make informed sourcing decisions. The benefits are real, but so are the challenges.

The Cost Advantage is Genuine

Chinese hotel furniture costs 30-50% less than equivalent US or European products before shipping. A standard room furniture package runs $500-800 from China versus $1,200-2,000 from Western suppliers.

Amenities show even wider gaps. Chinese toiletries cost $0.35-1.50 per unit. Western equivalents start at $2.00-4.00. For a 200-room hotel replacing amenities daily, this equals $50,000-70,000 in annual savings.

These savings come from lower labor costs, efficient raw material sourcing, and massive production scale. A single Chinese factory often produces more monthly volume than an entire Western manufacturer produces annually.

The complete picture: Add $15-30 per room for shipping and 10-25% for US tariffs. Even after these costs, total savings typically reach 20-35%. For a 200-room hotel, that’s $40,000-70,000 in furniture costs alone.

Geographic Concentration Creates Efficiency

Foshan produces 40% of China’s hotel furniture. Guangzhou hosts major amenity manufacturers. Yangzhou specializes in hotel textiles. This clustering creates advantages:

You can source furniture, linens, and amenities from suppliers within 200 kilometers. Consolidating shipments into single containers cuts per-unit shipping costs by 25-40%. Suppliers in the same region often coordinate on logistics.

Western suppliers scatter across different countries. Italian furniture. Portuguese textiles. French amenities. Each requires separate negotiations, shipping arrangements, and quality protocols.

Production Scale Matters

Galaxy Hospitality produces over 1 million textile pieces monthly. Yabo’s facility can simultaneously outfit multiple 200-room properties. This scale means:

- Rush orders are actually possible (Western suppliers often can’t accommodate)

- Consistent quality across large volumes

- Lower per-unit costs due to economies of scale

- Ability to scale when opening multiple properties

Export Infrastructure is Mature

Top Chinese suppliers have exported for 10-20+ years. They understand international documentation requirements. They maintain relationships with reliable freight forwarders. They know Western quality expectations.

This experience shows in on-time delivery rates. Major suppliers hit 95% on-time delivery according to 2025 industry data. They’ve learned from mistakes. They’ve built systems that work.

Innovation Accelerates

China’s domestic hospitality market5 reached $84 billion in 2025 with 7.24% projected annual growth. This booming internal market pushes innovation:

- 65% of top suppliers now hold environmental certifications (FSC, REACH, OEKO-TEX)

- Green premiums dropped to 10-15% above standard products (down from 50% five years ago)

- IoT-enabled locks and smart amenities reach market faster than in Western countries

- Sustainability options becoming standard offerings rather than premium add-ons

What Actually Matters When Choosing Suppliers

Skip the generic advice about "checking references" and "requesting samples." Focus on these China-specific factors that experienced buyers prioritize.

Certifications That Actually Matter

ISO 9001 is table stakes. Every serious supplier has it. Don’t celebrate finding it—worry if a supplier lacks it.

These certifications truly differentiate:

FSC (Forest Stewardship Council) – Required if your hotel pursues LEED certification. Many hotel chains now mandate FSC for corporate sustainability reporting. Suppliers without it can’t participate in these projects.

CARB Phase 2 – Legally required for California and EU furniture sales. Limits formaldehyde emissions. Most Chinese suppliers lack this certification. If you’re furnishing West Coast or European properties, verify this specifically.

OEKO-TEX Standard 100 – Tests textiles for harmful substances. Increasingly demanded by health-conscious hotel brands. Goes beyond basic safety to measure heavy metals, pesticides, and allergens.

GMPC (Good Manufacturing Practice for Cosmetics) – Essential for amenity suppliers. EU markets legally require it. Shows the facility meets hygiene standards for cosmetic production.

How to verify: Request certificate copies. Check certificate numbers on issuing organization websites. Fake certificates exist. Verification takes 10 minutes and prevents months of problems.

MOQ Flexibility Reveals Business Model

Minimum Order Quantities tell you who the supplier really serves:

- MOQ under 50 room sets or 3,000 amenity units: Targets boutique hotels and first-time buyers

- MOQ 50-100 room sets or 5,000-10,000 units: Serves mid-market chains

- MOQ above 100 room sets or 10,000+ units: Focuses on large chains and developers

Reality check: Suppliers claiming "flexible MOQs" often mean flexible for their regular customers after 2-3 orders. First orders typically hit stated minimums.

Negotiation opportunity: For first orders, accepting standard specifications (no custom colors, no embroidery, no special materials) can reduce MOQs by 30-40%.

English Communication is Non-Negotiable

You cannot successfully manage a Chinese supplier relationship through translation apps and broken English. Communication problems create cascading failures:

- Design specifications get misunderstood

- Production issues aren’t reported until too late

- Quality problems aren’t explained clearly

- Delivery delays get communicated vaguely

Test this during initial contact:

- Do they respond to detailed questions fully?

- Can they explain technical specifications clearly?

- Do they ask clarifying questions when your requirements are ambiguous?

Poor English communication isn’t a minor inconvenience. It’s a project-killing problem. Choose suppliers with fluent English-speaking sales teams.

Export Experience to Your Specific Market

A supplier experienced with European clients understands REACH compliance. A supplier serving US clients knows CARB requirements. A supplier working with Middle Eastern hotels grasps cultural considerations.

Ask specifically:

- "How many projects have you completed in [your region]?"

- "Can you provide references from hotels in [your country]?"

- "Which freight forwarders do you use for [your destination]?"

Vague answers signal limited experience. Specific answers with client names, forwarder relationships, and regional knowledge signal genuine expertise.

Installation and After-Sales Support

This separates professional suppliers from transactional ones:

Installation support matters for furniture orders above 100 rooms. Assembling furniture correctly prevents guest complaints and early failures. Suppliers offering installation teams (like Richang) reduce your local labor costs and timeline risks.

After-sales responsiveness reveals character. Ask references specifically: "When you had a problem, how quickly did they respond? Did they air-ship replacements for urgent issues? Did they produce matching items when you needed more two years later?"

Fast responders handle problems. Slow responders create them.

How to Source Successfully from Chinese Suppliers

Based on what actually works for international hotel buyers, not generic procurement theory.

Start with Realistic Requirements

Define these before contacting any supplier:

- Exact specifications (not "nice towels" but "600 GSM cotton, white, with 3-inch hem")

- Realistic quantities (don’t ask for quotes on 500 rooms if you’re only ordering 100)

- Actual timeline (hotels always open later than planned—build buffer)

- Real budget (including shipping and tariffs, not just product cost)

Why this matters: Suppliers get 50+ inquiries weekly. Detailed RFQs get serious attention. Vague inquiries get template responses.

Sample Evaluation Reveals Everything

Order samples from your top 3-5 suppliers. Cost runs $150-400 per supplier including shipping. This investment prevents disasters.

What samples actually tell you:

Material honesty: Does the 600-thread-count sheet actually feel like 600 threads? Does the "solid oak" furniture use real oak or veneered particle board?

Construction quality: Are towel hems even? Do furniture joints fit tightly? Does hardware operate smoothly?

Consistency: Order 2-3 identical items. Do they match perfectly? Variations signal quality control problems.

Real-world testing: Give samples to housekeeping staff. Let them wash the towels five times. Have maintenance staff stress-test the furniture joints. Their practical feedback catches issues you’ll miss.

Factory Verification Prevents Surprises

If you can visit China: Tour the factory. Observe the production floor during working hours. Look for:

- Modern equipment or outdated machinery

- Organized workflow or chaotic conditions

- Active quality control stations or none visible

- Clean environment or concerning hygiene

Professional suppliers welcome visits. Reluctant suppliers hide problems.

Can’t visit personally? Third-party inspection services6 (SGS, Bureau Veritas, Intertek) conduct factory audits for $500-1,500. They verify production capacity, quality systems, and compliance.

Minimum option: Video factory tour via WeChat or Zoom during production hours. Ask them to walk through the complete production process while showing actual work. Staged tours are obvious—real production environments look busy and functional, not spotless and empty.

Negotiation Tactics That Actually Work

Volume leverage:

- Orders above 200 room sets unlock 12-18% discounts at most suppliers

- Committing to 3 orders over 18 months earns 10-15% better baseline pricing

- Quarterly orders of 100+ units typically qualify for preferred pricing tiers

Specification trade-offs:

- Standard colors versus custom matching: saves 8-12%

- Stock fabrics versus custom materials: saves 15-25%

- Standard hardware versus designer handles: saves 10-15%

Payment term opportunities:

- Standard terms: 30% deposit, 70% before shipping

- After 2-3 successful orders: negotiate 10-20% retention until delivery

- After established relationship: some suppliers offer NET-30 terms

What doesn’t work: Aggressive haggling without justification. Chinese suppliers expect negotiation but respect reasonable offers. Demanding 40% discounts destroys relationships.

Pre-Shipment Inspection is Non-Negotiable

Third-party inspection costs $250-400 per day. This investment prevents thousands in returns, replacements, and delays.

Schedule inspection at 80% production completion. This timing allows corrections before final production. Use third-party companies, never rely on supplier self-inspection.

Inspect specifically:

- Products match approved samples (not similar—identical)

- Quantities are complete and correct

- Packaging protects products adequately (furniture gets beat up during shipping)

- All required documentation is complete and accurate

For ongoing relationships: Random inspection of 20-30% of shipments maintains quality standards. Suppliers knowing you inspect randomly stay careful.

Manage Logistics Proactively

Choose FOB (Free On Board) terms for maximum control. The supplier delivers goods to the ship. You arrange international shipping and insurance. This gives you:

- Choice of freight forwarder (competitive rates)

- Control of shipping schedule

- Direct relationship with shipping company for problem resolution

Container economics matter:

- 40-foot container to US East Coast: $3,500-6,500 (fluctuates seasonally)

- Container holds approximately 250-300 room sets or 20,000-30,000 amenity units

- Consolidating multiple product categories splits shipping costs

Customs preparation prevents delays:

- Research exact tariff rates using harmonized codes before ordering

- Prepare all documentation (commercial invoices, packing lists, certificates of origin)

- Use an experienced customs broker ($150-400 per shipment, worth every dollar)

Common mistake: Underestimating port storage fees. You typically get 5-7 free days at port. After that, storage runs $75-150 per day. Have your delivery plan ready before the ship arrives.

Real Costs: Complete Breakdown

Most cost guides show product prices and ignore everything else. Here’s the complete picture based on a typical 100-room hotel project.

Product Cost Ranges (FOB China)

| Product | Budget Tier | Mid-Market | Premium |

|---|---|---|---|

| Complete room furniture set | $450-650 | $650-1,100 | $1,100-2,800 |

| Bed linen set (sheets, cases, duvet cover) | $35-55 | $55-85 | $85-160 |

| Bath towel set (bath, hand, face) | $18-28 | $28-45 | $45-75 |

| Bathrobe | $9-14 | $14-22 | $22-45 |

| Slippers (per pair) | $0.60-1.20 | $1.20-2.20 | $2.20-5.50 |

| 4-piece toiletry set | $0.90-1.60 | $1.60-3.20 | $3.20-6.50 |

Budget tier serves limited-service properties. Mid-market suits most three-star and four-star hotels. Premium targets five-star and luxury boutique properties.

Shipping Costs (To US Destinations)

Container shipping from major Chinese ports:

| Container Size | West Coast | East Coast | Capacity |

|---|---|---|---|

| 20-foot | $2,500-4,500 | $3,500-5,500 | 150-180 room sets |

| 40-foot | $3,500-6,500 | $5,000-8,000 | 250-300 room sets |

Rates fluctuate 30-50% based on season. January-March and September-October typically offer lowest rates.

Additional logistics costs:

- Port terminal handling: $350-650 per container

- Customs brokerage: $150-400 per shipment

- Inland transport (100 miles): $600-1,200 per container

- Cargo insurance: 0.4-0.6% of shipment value

US Import Tariffs (2025 Rates)

| Product Category | Typical Tariff Rate |

|---|---|

| Wood furniture | 0-5% (some categories up to 25%) |

| Upholstered furniture | 0-5% |

| Bed linens (cotton) | 7-12% |

| Towels (cotton) | 8-11% |

| Bathrobes | 9-14% |

| Toiletries/amenities | 0-6.5% |

Tariffs apply to CIF value (product cost + shipping). Check current rates—trade policies change.

Sample Total Landed Cost

100-room hotel, mid-market specifications:

Product costs (FOB China):

- 100 furniture sets @ $800: $80,000

- 100 linen sets @ $65: $6,500

- 100 towel sets @ $32: $3,200

- 100 bathrobes @ $16: $1,600

- 200 slippers @ $1.50: $300

- 500 toiletry sets @ $2: $1,000

- Subtotal: $92,600

Shipping (40-foot container to Los Angeles):

- Container freight: $5,200

- Port handling: $450

- Customs brokerage: $300

- Inland transport (50 miles): $700

- Insurance: $370

- Subtotal: $7,020

Tariffs and duties:

- Furniture (3% average): $2,400

- Textiles (10% average): $1,170

- Amenities (4%): $40

- Subtotal: $3,610

Total landed cost: $103,230

Cost per room: $1,032

Comparable US domestic sourcing: $1,900-2,400 per room

Your savings: $867-1,368 per room (46-57%)

Cost Reduction Strategies

Consolidate categories: Order furniture, linens, and amenities in one container. Splits shipping across all products, reducing per-unit costs by 25-35%.

Time purchases strategically: Shipping rates drop 20-30% during February-March and September-October. Plan orders during these windows when possible.

Standardize specifications: Custom colors add 10-15%. Custom embroidery adds 15-20%. Special materials add 20-40%. Use standard options for back-of-house items.

Commit to repeat orders: Two-year agreements with quarterly orders typically earn 12-18% discounts. Suppliers value predictable volume.

Negotiate payment terms: Standard 30/70 terms (30% deposit, 70% before shipping) are starting points. After 2-3 successful orders, negotiate for 30-day terms after delivery.

Common Mistakes That Cost Time and Money

Choosing Based on Lowest Price

The cheapest quote usually signals problems:

- Lower quality materials (200-thread-count sold as 400-thread-count)

- Inexperienced export handling (documentation errors cause customs delays)

- Poor communication (misunderstood specifications require remakes)

- Weak quality control (high defect rates require replacements)

Better approach: Get 5 quotes. Eliminate the highest and lowest. Choose from the middle three based on certifications, references, and communication quality.

Skipping Sample Orders

"The photos look good" is not quality verification. Photos show the best examples. Production quality varies. Samples reveal:

- Actual materials used (not just claimed)

- Construction quality under close inspection

- How products hold up after washing/use testing

- Whether supplier can deliver what they promise

Cost of skipping: We’ve seen buyers receive 200-room furniture orders that don’t match samples. Replacement costs exceed $100,000. Sample investment: $300.

Inadequate Timeline Buffers

Chinese production typically runs on schedule. Shipping rarely does. Add these buffers:

- Production delays: Add 2 weeks to quoted lead times

- Shipping delays: Add 1-2 weeks for weather, port congestion

- Customs delays: Add 3-5 days for unexpected inspections

- Inland transport: Add 3-5 days for coordination

Reality: Hotel openings always slip. If you need furniture by June 1, order for May 1 delivery. You’ll probably receive it May 15, which still works.

Ignoring Total Landed Cost

Product price is 70-75% of total cost. Forgetting the other 25-30% destroys budgets.

Calculate this before ordering:

- Product cost (FOB)

-

- Shipping cost per unit

-

- Tariffs (on product + shipping value)

-

- Port fees + customs + inland transport

- = Total landed cost per unit

Compare total landed cost to domestic alternatives, not just product prices.

Poor Communication Follow-Up

Place the order and disappear until shipment? You’ll have problems.

Stay engaged:

- Week 1: Confirm deposit received and production scheduled

- Production midpoint: Request progress photos

- Week before completion: Arrange pre-shipment inspection

- Week before shipping: Confirm vessel and expected arrival

- During transit: Track shipment and prepare receiving logistics

Problems caught early cost less to fix.

Conclusion

China dominates hotel supply manufacturing for good reasons. The cost advantages are real—20-35% savings on total landed costs. The production capacity is unmatched. The export infrastructure works efficiently. The innovation pace accelerates.

But success requires diligence. Choose suppliers based on certifications, export experience, and communication quality rather than price alone. Verify everything through samples, factory visits, and third-party inspections. Calculate complete costs including shipping and tariffs before committing.

Key takeaways:

Cost savings require careful planning. Product prices are 30-50% lower, but total savings land at 20-35% after shipping, tariffs, and quality control. Still substantial for multi-property portfolios.

Supplier selection matters more than negotiation. A reliable supplier charging 10% more prevents returns, delays, and quality issues that cost far more. Focus on proven track records over aggressive pricing.

Thorough processes prevent expensive problems. Request samples. Verify certifications. Conduct pre-shipment inspections. These steps feel time-consuming but become routine. They’re non-negotiable for consistent results.

China’s hotel supply market continues improving. Sustainability certifications are becoming standard. Smart technology integration is accelerating. Production quality improves as domestic demand pushes innovation. The suppliers we’ve listed here lead these improvements.

The market is growing too. China’s hospitality sector is projected to reach $170 billion by 2033 with 8.23% annual growth. This expansion drives supplier investment in capabilities, certifications, and customer service. International buyers benefit from these improvements regardless of where their properties are located.

How Hotemax Supports International Hotel Buyers

We’ve shared insights about 10 leading suppliers because we genuinely want you to succeed with China sourcing. Choose the supplier that fits your specific needs—whether that’s Yabo for luxury furniture, JETWAY for comprehensive amenity programs, or any of the other suppliers we’ve listed.

For textile and amenity sourcing specifically, we’d welcome the opportunity to work with you. Hotemax specializes in making this category straightforward for international buyers:

- OEKO-TEX certified textiles meet health and environmental standards

- Integrated sourcing handles linens and amenities in coordinated orders

- English-speaking team eliminates communication barriers

- Flexible customization from simple embroidery to complete brand programs

- Quality control before shipment prevents receiving defective products

We handle projects from 50-room boutique hotels to 500-room chain properties. Our MOQs start at 500 pieces for standard items, making us accessible to smaller properties while still serving larger chains efficiently.

Visit hotemax.com to request product samples, review our certifications, or discuss your specific project requirements. We’re based in Shenzhen with direct access to manufacturing and shipping infrastructure that keeps our lead times competitive.

Whether you choose Hotemax or another supplier from this list, we hope this guide helps you navigate China’s hotel supply market successfully. The opportunities are significant. The challenges are manageable with the right approach.

Footnotes:

-

ISO 22716 establishes Good Manufacturing Practice guidelines for cosmetics production, ensuring hotel amenities are manufactured under strict hygiene and quality controls that meet international safety standards. ↩

-

FSC certification verifies that wood products come from responsibly managed forests, helping hotels meet LEED requirements and corporate sustainability goals while protecting global forest ecosystems. ↩

-

CARB Phase 2 certification limits formaldehyde emissions from composite wood products to protect indoor air quality, and is legally required for furniture sold in California and EU markets. ↩

-

OEKO-TEX Standard 100 certification tests textiles for over 100 harmful substances including formaldehyde, heavy metals, and pesticides, ensuring hotel linens are safe for guest contact and meet health standards. ↩

-

China’s hospitality market growth reflects the booming domestic tourism sector with 2.725 billion trips in 2024, driving continuous innovation and competitive pricing among hotel suppliers. ↩

-

Third-party inspection companies like SGS, Bureau Veritas, and Intertek provide independent factory audits and quality verification services, helping international buyers ensure supplier reliability before placing large orders. ↩