The American hotel supplies market has undergone dramatic changes since 2020. I’ve spent the last three years analyzing supplier performance, tracking market shifts, and helping hotel operators navigate these turbulent waters. What I’ve discovered is a landscape where traditional assumptions no longer apply.

Supply chain disruptions1 forced many hotels to rethink their sourcing strategies. Guest expectations around cleanliness and sustainability reached new heights. Technology integration accelerated from nice-to-have to absolutely essential. These changes created winners and losers in the supplier ecosystem.

The U.S. hotel supplies market generates over $15 billion annually, yet remains remarkably fragmented. No single supplier controls more than 15% market share. This fragmentation benefits smart buyers who understand how to leverage competition for better pricing and service.

I’ve evaluated dozens of suppliers based on real-world performance data, customer feedback, and industry trends. The suppliers in this guide represent the most reliable partners for different types of hotel operations in 2025.

What Makes a Top Hotel Supplier in 2025?

The criteria for evaluating hotel suppliers have evolved significantly. Price alone no longer determines the best choice. I use five critical factors that directly impact your hotel’s profitability and guest satisfaction.

Product Quality and Consistency

Quality consistency across large orders separates top suppliers from mediocre ones. I’ve seen hotels receive towels that disintegrated after 50 washes instead of the promised 200. The best suppliers maintain strict quality control processes and offer performance guarantees.

Top suppliers test their products under real hotel conditions. They understand that hotel linens face harsher treatment than residential use. Their quality standards reflect this reality through reinforced stitching, fade-resistant dyes, and shrinkage controls.

Distribution Speed and Reliability

Post-pandemic hotels can’t afford inventory stockouts. When your housekeeping runs out of towels during peak occupancy, every hour counts. The best suppliers maintain multiple distribution centers and offer emergency delivery services.

I prioritize suppliers with same-day or next-day delivery capabilities in major markets. Regional suppliers often outperform national companies in delivery speed due to proximity and flexibility.

Technology Integration

Modern hotel operations require seamless technology integration. The best suppliers offer online ordering systems that integrate with your property management system. Automated reordering based on usage patterns reduces administrative overhead.

Real-time inventory tracking prevents both stockouts and overordering. Mobile apps for emergency orders give you flexibility when situations change quickly.

Sustainability Leadership

Hotel guests increasingly choose properties based on environmental practices. I’ve seen hotels boost their review scores by partnering with suppliers who offer eco-friendly alternatives without sacrificing quality.

Sustainable suppliers2 often provide better long-term value through product durability. Their products may cost 10-15% more initially but last 30-40% longer than conventional alternatives.

Customer Service Excellence

When problems occur, responsive customer service prevents operational disasters. The suppliers I recommend maintain dedicated hotel industry support teams who understand your unique challenges.

24/7 customer service becomes crucial for hotels operating around the clock. Emergency replacement capabilities can save thousands in lost revenue when critical supplies fail.

Comprehensive Top 10 Supplier Analysis

| Rank | Supplier Name | Primary Specialty | Best For | Delivery Speed | Pricing Level |

|---|---|---|---|---|---|

| 1 | HD Supply Facilities | MRO Supplies | Large chains, complex maintenance | Same-day available | Mid-range |

| 2 | American Hotel Register | Comprehensive solutions | Full-service hotels | 2-3 business days | Premium |

| 3 | Guest Supply (Sysco) | Guest amenities | Premium hotels, branded chains | 3-5 business days | Premium |

| 4 | National Hospitality Supply | Value pricing | Independent hotels | 5-7 business days | Budget-friendly |

| 5 | DZEE Textiles | U.S. manufacturing | Domestic sourcing priority | 1-2 business days | Competitive |

| 6 | Ramayan Supply | Customization | Boutique hotels | Regional fast | Competitive |

| 7 | Exquisite Hotel Supply | Luxury products | High-end properties | White-glove service | Premium |

| 8 | Mayfair Hotel Supply | Essential supplies | Economy hotels | Standard reliable | Budget |

| 9 | Universal Hotel Supply | Basic needs | Budget operations | Standard shipping | Lowest cost |

| 10 | Hospitality1 Source | Project management | Renovations, new construction | Project-coordinated | Project-based |

1. HD Supply

HD Supply dominates maintenance, repair, and operations supplies with unmatched technical expertise and distribution capabilities. Their strength lies in keeping hotels operational through reliable access to HVAC parts, plumbing components, and electrical supplies.

Best For: Large hotel chains, properties with complex maintenance needs

Specialty: MRO supplies, technical support, emergency service

Key Products: HVAC systems, plumbing fixtures, electrical components, janitorial equipment

I recommend HD Supply for properties where operational reliability trumps lowest initial cost. Their technical support team can troubleshoot complex mechanical issues over the phone, often preventing expensive service calls.

Their nationwide distribution network ensures parts availability even for older equipment. When your 20-year-old boiler needs a specific component, HD Supply’s sourcing capabilities often succeed where others fail.

2. American Hotel Register Company

With over 100 years serving the hospitality industry, American Hotel Register brings unmatched experience and product breadth. Their catalog spans 40,000+ products from basic linens to cutting-edge guest room technology.

Best For: Full-service hotels requiring comprehensive solutions

Specialty: Guest room amenities, technology integration, custom programs

Key Products: Linens, guest amenities, furniture, technology solutions

Their recent focus on innovation includes antimicrobial textiles and smart room technologies. I’ve seen their custom amenity programs significantly boost guest satisfaction scores for branded hotels.

Quality consistency across their vast product range sets them apart. Whether you’re ordering 100 towels or 10,000, you receive identical quality and specifications.

3. Guest Supply (Sysco Company)

Guest Supply’s acquisition by Sysco enhanced their already strong position in hotel amenities and guest supplies. They excel in personal care products, guest room accessories, and custom branding programs.

Best For: Premium hotels, branded chains requiring customization

Specialty: Guest amenities, personal care, custom branding

Key Products: Toiletries, bathrobes, slippers, welcome amenities

Their partnerships with major hotel brands demonstrate ability to meet exacting standards while scaling across thousands of properties. Custom scent programs and branded packaging create memorable guest experiences.

Quality control processes include batch testing and guest feedback integration. They actively monitor guest reviews to identify product improvement opportunities.

4. National Hospitality Supply

National Hospitality Supply built their reputation on competitive pricing and efficient online ordering systems. Their focus on value attracts independent hotels and smaller chains seeking cost optimization.

Best For: Budget-conscious properties, independent hotels

Specialty: Competitive pricing, online ordering efficiency

Key Products: Basic linens, housekeeping supplies, guest amenities

Their streamlined operations eliminate many traditional distribution costs, passing savings to customers. Online ordering systems provide 24/7 access with real-time inventory visibility.

Product selection focuses on essential items with proven performance rather than premium options. This approach works well for properties prioritizing functionality over luxury positioning.

5. DZEE Textiles

DZEE Textiles stands out as a U.S.-based manufacturer with direct factory control over quality and pricing. Their domestic production provides supply chain reliability and faster turnaround times.

Best For: Hotels prioritizing domestic sourcing and quick delivery

Specialty: U.S. manufacturing, textile durability, custom specifications

Key Products: Linens, towels, mattress protection, custom textiles

Post-pandemic supply chain concerns increased demand for domestic suppliers. DZEE’s ability to reduce lead times by 50% compared to imported alternatives provides significant operational advantages.

Their manufacturing expertise allows custom specifications without the typical minimum order penalties. Properties can modify thread counts, colors, or sizes to meet specific requirements.

6. Ramayan Supply

This family-owned supplier excels in personalized service and customizable amenities, with particular strength in the southeastern United States. Their relationship-focused approach suits boutique hotels requiring unique solutions.

Best For: Boutique hotels, properties needing customization

Specialty: Personalized service, custom amenities, regional expertise

Key Products: Custom amenities, specialty textiles, unique guest supplies

Ramayan’s willingness to work with smaller orders and provide extensive customization makes them ideal for properties differentiating through unique guest experiences.

Their southeastern regional focus allows deep relationships with local properties. Account managers understand regional preferences and can source specialty items quickly.

7. Exquisite Hotel Supply

Exquisite Hotel Supply focuses exclusively on upscale products including luxury bathrobes, premium slippers, and high-end toiletry collections. Their curated selection appeals to luxury properties and boutique hotels.

Best For: Luxury hotels, high-end boutique properties

Specialty: Premium guest amenities, luxury textiles, exclusive products

Key Products: Luxury bathrobes, premium slippers, high-end toiletries, spa products

For properties where guest experience justifies premium pricing, Exquisite offers products that enhance perceived value and drive positive reviews.

Their product curation process involves extensive testing and guest feedback analysis. Only products meeting luxury standards make their catalog.

8. Mayfair Hotel Supply

Mayfair Hotel Supply provides practical, cost-effective solutions for essential hotel needs. Their straightforward approach appeals to operators focused on functionality and value.

Best For: Economy hotels, extended stay properties, practical operators

Specialty: Essential supplies, functional design, value pricing

Key Products: Basic linens, housekeeping supplies, practical amenities

Properties operating on thin margins benefit from Mayfair’s no-frills approach while still meeting guest expectations for cleanliness and comfort.

Product selection emphasizes durability and functionality over aesthetics. This focus delivers excellent value for properties where cost control is paramount.

9. Universal Hotel Supply

Universal Hotel Supply targets cost-conscious operators with essential room accessories, basic textiles, and fundamental amenities. Their value proposition centers on meeting basic needs efficiently.

Best For: Budget hotels, motels, extended stay facilities

Specialty: Essential supplies, budget optimization, basic quality

Key Products: Basic towels, sheets, essential amenities, housekeeping basics

When profit margins demand careful cost control, Universal provides reliable basics that meet fundamental guest expectations without premium features.

Their product line focuses on items with proven durability and guest acceptance. No unnecessary features or premium materials inflate costs.

10. Hospitality1 Source

Hospitality1 Source combines furniture, fixtures, and technology solutions with traditional supplies, offering comprehensive project management for renovations and new constructions.

Best For: Properties undergoing renovation, new hotel construction

Specialty: Project management, comprehensive solutions, design coordination

Key Products: Furniture, fixtures, technology, traditional supplies

Their project management capabilities coordinate complex renovations involving multiple product categories and vendors. This coordination reduces delays and ensures design consistency.

Design services help properties create cohesive aesthetics while managing budgets effectively. Their experience with hotel projects provides valuable planning insights.

How to Choose the Right Supplier

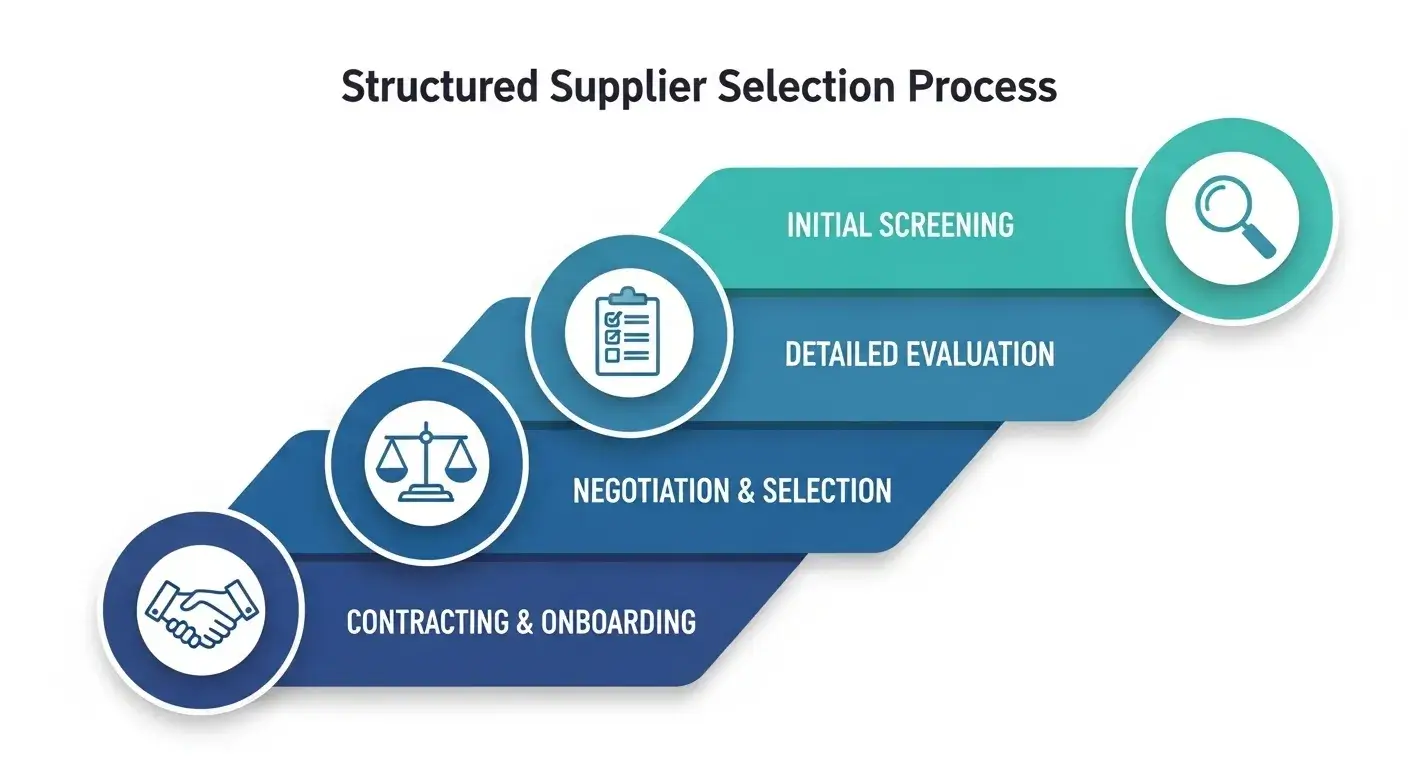

Selecting hotel suppliers requires systematic evaluation beyond initial price comparisons. I’ve developed a framework that considers total value and long-term partnership potential.

Supplier Evaluation Scorecard

| Evaluation Criteria | Weight | Scoring Method | Minimum Acceptable Score |

|---|---|---|---|

| Cost Competitiveness | 30% | Total cost analysis vs. market | 7/10 |

| Product Quality | 25% | Sample testing + references | 8/10 |

| Service Reliability | 20% | Delivery performance + support | 8/10 |

| Innovation/Sustainability | 15% | Product offerings + certifications | 6/10 |

| Financial Stability | 10% | Credit rating + insurance | 7/10 |

Initial Assessment Criteria

Start with fundamental requirements that eliminate unsuitable suppliers:

Geographic Coverage: Ensure delivery capabilities match your property locations. Regional suppliers may offer better service than nationals in specific areas.

Product Breadth: Evaluate whether suppliers offer comprehensive solutions or require multiple vendor relationships. Consider the administrative efficiency of fewer suppliers versus specialized expertise.

Financial Stability: Review financial ratings and insurance coverage. Supplier bankruptcies can disrupt operations at critical times.

Regulatory Compliance: Verify certifications for products requiring specific standards (fire retardant textiles, food service items, safety equipment).

Quality Evaluation Process

Request samples across all major purchasing categories. Test samples through your actual operations rather than visual inspection alone.

Textile Testing: Have housekeeping evaluate fabrics through complete washing cycles. Test absorbency, shrinkage, and durability under real-world conditions.

Amenity Assessment: Guest services should evaluate packaging quality, product performance, and guest appeal of toiletries and amenities.

Operational Supply Review: Maintenance staff should assess tools, cleaning products, and mechanical components for functionality and durability.

Service Level Requirements

Define specific performance standards and measurement methods:

| Service Metric | Standard Level | Premium Level | Measurement Method |

|---|---|---|---|

| Order Accuracy | 98% | 99.5% | Monthly error rate tracking |

| Delivery Performance | 95% on-time | 98% on-time | Delivery date compliance |

| Customer Service Response | 24 hours | 4 hours | Response time logging |

| Emergency Orders | Next business day | Same day | Fulfillment speed tracking |

Financial Analysis Framework

Total cost analysis must include all relevant factors:

Unit Pricing: Compare costs across volume tiers and long-term contracts. Hidden fees can significantly impact true costs.

Delivery Charges: Evaluate shipping costs, minimum order requirements, and free delivery thresholds. Frequent small orders may cost more than bulk purchasing.

Payment Terms: Consider cash flow impact of payment terms. Early payment discounts may provide significant savings opportunities.

Contract Benefits: Long-term commitments often provide price protection and enhanced service levels. Balance savings against flexibility needs.

Trial Period Strategy

I recommend 90-day trial periods before committing to annual contracts. This timeframe allows comprehensive evaluation across multiple order cycles.

Performance Monitoring: Track delivery accuracy, quality consistency, and service responsiveness throughout the trial period.

Cost Analysis: Compare actual costs including all fees and charges to initial estimates. Hidden costs often emerge during real-world use.

Operational Impact: Evaluate administrative efficiency, staff satisfaction, and guest feedback during the trial period.

Common Sourcing Challenges and Solutions

Hotel supply sourcing faces unique challenges requiring proactive management and strategic supplier relationships. I’ve identified the most common issues and proven solutions.

Supply Chain Disruption Management

| Risk Level | Challenge Type | Impact | Mitigation Strategy |

|---|---|---|---|

| High | Single supplier dependency | Operations halt | Dual supplier strategy |

| Medium | Import delays | Inventory shortages | Domestic sourcing preference |

| Medium | Quality inconsistencies | Guest satisfaction drop | Rigorous testing protocols |

| Low | Payment term changes | Cash flow impact | Diversified payment terms |

Post-pandemic supply chains remain vulnerable to various disruptions. Successful hotels maintain diversified supplier relationships and strategic inventory management.

Dual Supplier Strategy: Maintain primary suppliers for 70-80% of needs while qualifying backup suppliers for critical categories. This approach provides security without sacrificing primary supplier benefits.

Strategic Inventory: Increase safety stock for critical items (cleaning supplies, basic linens) while maintaining just-in-time delivery for less essential products.

Domestic Preference: Prioritize U.S.-based suppliers for items where delivery speed matters more than absolute lowest cost. Domestic suppliers typically provide greater supply chain reliability.

Quality Consistency Issues

Product quality variations can significantly impact guest satisfaction and operational efficiency. Proactive quality management prevents problems before they affect guests.

Incoming Inspection: Implement sampling procedures for textile and amenity deliveries. Random testing identifies quality issues before distribution to guest rooms.

Supplier Quality Agreements: Establish written quality standards with specific acceptance criteria. Include corrective action procedures for quality failures.

Performance Trending: Monitor quality metrics over time to identify degrading performance before it becomes problematic.

Cost Management Strategies

| Cost Control Method | Potential Savings | Implementation Difficulty | Timeline |

|---|---|---|---|

| Volume consolidation | 10-15% | Easy | 30 days |

| Contract timing optimization | 5-8% | Medium | 90 days |

| Specification value engineering | 8-12% | Medium | 60 days |

| Payment term optimization | 2-3% | Easy | Immediate |

Rising costs require strategic approaches to maintain profitability while preserving guest experience quality.

Contract Timing: Lock in pricing for critical items during stable cost periods. Maintain flexibility for categories with declining costs.

Value Engineering: Work with suppliers to identify specification changes that reduce costs without impacting guest perception. Thread count reductions may be acceptable if durability remains adequate.

Total Cost Analysis: Consider durability, maintenance requirements, and disposal costs alongside initial purchase prices. Premium products often provide better total cost value.

Technology Integration Challenges

Supplier technology solutions can improve efficiency but require careful implementation planning.

System Compatibility: Ensure supplier platforms integrate with existing property management and procurement systems. Standalone systems create administrative overhead.

Training Requirements: Budget adequate time for staff training on new ordering systems. Poor adoption can negate technology benefits.

Data Security: Evaluate supplier cybersecurity practices, especially when sharing guest data or property operational information.

Regional Considerations and Market Insights

The U.S. hotel supply market varies significantly by region, affecting supplier selection and pricing strategies. Understanding these variations helps optimize sourcing decisions.

Geographic Market Analysis

| Region | Market Characteristics | Top Supplier Advantages | Pricing Trends |

|---|---|---|---|

| Northeast | High density, competitive | Better pricing, traffic delays | 5-8% above national average |

| Southeast | Growing market, regional focus | Personalized service, lower costs | 3-5% below national average |

| West Coast | Environmental regulations | Sustainability focus, higher transport | 8-12% above national average |

| Midwest | Balanced competition | Manufacturing base, reasonable costs | National average baseline |

| Southwest | Rapid hotel growth | Emerging opportunities | 2-4% below national average |

Geographic Market Dynamics

Northeast Corridor: High hotel density creates competitive supplier environment with generally favorable pricing. Traffic congestion can impact delivery reliability during peak periods.

Southeast Region: Growing hotel market attracts regional suppliers offering competitive pricing and personalized service. Lower operational costs often translate to better value.

Western States: Higher transportation costs favor suppliers with local distribution presence. Environmental regulations drive demand for sustainable products.

Midwest Markets: Balanced supplier competition with reasonable transportation costs. Strong manufacturing base provides domestic sourcing opportunities.

Seasonal Demand Patterns

Understanding seasonal variations helps optimize inventory management and supplier relationships:

| Season | Demand Characteristics | Key Focus Areas | Supplier Strategy |

|---|---|---|---|

| Summer Peak | High turnover items | Linens, amenities | Secure delivery capacity |

| Winter Maintenance | Renovation focus | MRO supplies, deep cleaning | Negotiate project pricing |

| Spring Shoulder | Transition period | New amenity programs | Trial new suppliers |

| Fall Shoulder | Budget planning | Contract negotiations | Lock favorable terms |

Summer Peak Season: Increase safety stock for high-turnover items while securing delivery capacity during peak demand periods.

Winter Maintenance Season: Focus on MRO supplies and renovation materials when occupancy typically declines.

Shoulder Seasons: Ideal timing for supplier transitions, deep cleaning projects, and implementing new amenity programs.

Market Evolution Trends

Several trends are reshaping regional supply markets:

Consolidation Activity: Large companies acquiring regional suppliers can improve distribution but may reduce service customization.

Technology Adoption: Regional suppliers increasingly offer advanced technology platforms previously available only from national suppliers.

Sustainability Focus: Regional environmental regulations drive product innovation and supplier capability development.

Industry analysts3 project 4-6% annual growth in the U.S. hotel supply market through 2027, driven by:

- Recovering travel demand post-pandemic

- Increased focus on hygiene and cleanliness

- Sustainability requirements from major hotel brands

- Technology adoption accelerating efficiency improvements

This growth creates opportunities for hotels to negotiate better terms while suppliers invest in capacity and capability improvements.

Sustainability and Innovation Trends

Environmental consciousness has shifted from optional to essential for hotel competitiveness. I’ve tracked significant changes in guest expectations and supplier capabilities over the past three years.

Eco-Friendly Product Evolution

| Product Category | Traditional Option | Eco-Friendly Alternative | Performance Benefits |

|---|---|---|---|

| Towels | Cotton blend | Bamboo fiber blend | 30% more absorbent, antimicrobial |

| Bed linens | Conventional cotton | Organic cotton | Hypoallergenic, chemical-free |

| Toiletries | Plastic bottles | Shampoo bars/refillables | 60% less packaging waste |

| Cleaning supplies | Standard chemicals | Concentrated eco-formulas | 20-30% cost reduction |

| Amenity packaging | Plastic wrapping | Biodegradable materials | Zero landfill impact |

Sustainable hotel supplies4 have moved beyond basic recycled content to sophisticated environmental solutions. Modern eco-friendly products often outperform conventional alternatives in durability and guest satisfaction.

Advanced Textile Technologies: Bamboo fiber linens provide natural antimicrobial properties while offering superior softness. Organic cotton products eliminate chemical treatments that can irritate sensitive guests. Recycled polyester blends create durable towels from post-consumer plastic bottles.

Biodegradable Amenities: Shampoo bars eliminate plastic bottles while lasting longer than liquid alternatives. Bamboo toothbrushes and recyclable packaging reduce waste without compromising guest experience.

Concentrated Cleaning Products: High-concentration formulas reduce packaging and shipping costs while providing superior cleaning performance. Many hotels report 20-30% cost savings switching to concentrated products.

Technology Integration Advances

Hotel supply technology has evolved beyond simple online ordering to comprehensive operational integration. The most advanced suppliers now offer predictive analytics and automated inventory management.

Smart Inventory Systems: RFID tracking and IoT sensors monitor supply usage in real-time. These systems automatically generate purchase orders when inventory reaches predetermined levels, preventing stockouts while minimizing overordering.

Predictive Analytics: Machine learning algorithms analyze historical usage patterns, occupancy forecasts, and seasonal trends to optimize ordering timing and quantities. Properties report 15-25% inventory cost reductions through predictive ordering.

Mobile Integration: Smartphone apps enable housekeeping staff to report supply needs instantly. Emergency orders can be placed and tracked from anywhere in the property.

Innovation Impact on Operations

Technology-enabled suppliers provide operational advantages that extend beyond cost savings. Real-time visibility into supply chains helps properties adapt quickly to changing conditions.

Quality Tracking: Digital systems monitor product performance through guest feedback integration. Suppliers can identify quality issues before they become widespread problems.

Sustainability Reporting: Automated systems track environmental metrics like waste reduction and energy savings from eco-friendly products. These reports support hotel sustainability certifications and marketing efforts.

Cost Optimization: Advanced analytics identify spending patterns and suggest alternatives that maintain quality while reducing costs.

Conclusion

The hotel supply industry in 2025 offers unprecedented opportunities for properties taking strategic approaches to supplier selection. Market fragmentation provides negotiating leverage while innovation in sustainability and technology creates competitive advantages.

Success requires moving beyond simple price comparisons to evaluate comprehensive value propositions. Each supplier in this guide offers distinct advantages for different property types and operational priorities.

Final Supplier Selection Matrix

| Property Type | Recommended Primary Supplier | Backup Supplier | Specialized Needs Partner |

|---|---|---|---|

| Luxury Hotels | American Hotel Register | Exquisite Hotel Supply | Guest Supply (amenities) |

| Full-Service Chains | HD Supply | DZEE Textiles | Guest Supply (branding) |

| Independent Hotels | National Hospitality Supply | Ramayan Supply | Mayfair Hotel Supply |

| Budget Properties | Universal Hotel Supply | Mayfair Hotel Supply | National Hospitality Supply |

| Boutique Hotels | Ramayan Supply | Exquisite Hotel Supply | American Hotel Register |

| Extended Stay | Mayfair Hotel Supply | Universal Hotel Supply | DZEE Textiles |

Key Selection Principles:

Diversification reduces operational risk. Don’t rely on single suppliers for critical categories. Maintain qualified alternatives to ensure continuity during disruptions.

Total cost analysis provides better value than unit price comparisons. Consider durability, delivery costs, service quality, and long-term relationship benefits.

Sustainability capabilities provide competitive differentiation. Guests increasingly choose properties based on environmental practices, making green suppliers strategic partners.

Technology integration improves operational efficiency. Modern suppliers offer systems that reduce administrative overhead while improving inventory management.

Regional suppliers often deliver superior service despite larger competitors’ scale advantages. Personal relationships and local market knowledge provide significant value.

Implementation Roadmap

| Phase | Timeline | Key Actions | Success Metrics |

|---|---|---|---|

| 1. Assessment | 30 days | Evaluate current suppliers, identify gaps | Baseline cost and service analysis |

| 2. Research | 45 days | Request proposals, sample testing | Qualified supplier shortlist |

| 3. Trial | 90 days | Implement trial orders, monitor performance | Performance scorecard completion |

| 4. Full Implementation | 60 days | Transition to selected suppliers | Cost savings and service improvement |

Implementation Strategy:

Start with comprehensive supplier evaluation using the framework provided. Request samples, check references, and conduct trial periods before making long-term commitments.

Develop relationships with 2-3 qualified suppliers in each major category. This approach provides backup options while maintaining primary supplier benefits.

Monitor performance continuously through defined metrics and regular reviews. Supplier relationships require ongoing management to maintain optimal value.

Future Outlook:

The hotel industry’s continued recovery creates opportunities for favorable supplier negotiations. Suppliers eager for long-term partnerships offer competitive terms and enhanced service levels.

Technology integration will accelerate across all supplier categories. Properties investing in modern supplier relationships gain operational advantages and cost savings.

Sustainability requirements will continue expanding. Early adoption of eco-friendly suppliers provides competitive positioning and often superior long-term value.

Whether you manage a single boutique property or oversee purchasing for a major chain, the suppliers profiled here represent America’s most reliable partners for successful hospitality operations.

The key is matching supplier strengths with your specific operational needs and guest expectations. Use this guide as your foundation, but remember that the best supplier relationships develop through clear communication, performance monitoring, and mutual commitment to excellence.

Ready to optimize your hotel supply chain? Start by requesting samples from 2-3 suppliers in each major category, focusing on those that align best with your property type and operational priorities. The investment in proper supplier selection will pay dividends through improved guest satisfaction, operational efficiency, and cost management for years to come.

-

AHLA survey data shows that 46% of hotels expect supply chain disruptions to last 6 months to a year, with another 36% expecting them to last more than a year, highlighting the ongoing impact of supply chain challenges on hotel operations. ↩

-

Industry research demonstrates that sustainable hotel practices, including eco-friendly supplier partnerships, are increasingly driving guest booking decisions and review scores, with properties reporting measurable improvements in guest satisfaction metrics. ↩

-

Official statistics from the U.S. hotel industry indicate continued market recovery and growth projections, with hotel room revenue reaching $97.8 billion in 2023 and forecasted continued growth supporting supplier market expansion. ↩

-

Current sustainability trends in hotel management show that eco-friendly alternatives like bamboo fiber textiles and concentrated cleaning products often deliver superior performance while reducing environmental impact and operational costs. ↩