Hotel procurement costs1 eat up 15-20% of your revenue. Finding the right suppliers can slash expenses while boosting guest satisfaction.

The five largest hotel supply companies in the USA for 2025 are American Hotel Register, Guest Supply (Sysco), HD Supply, DZEE Textiles, and National Hospitality Supply. These companies control approximately 60% of the market share through diverse product portfolios spanning amenities, linens, maintenance supplies, and operational equipment.

Understanding these industry giants helps me make smarter procurement decisions. Each supplier offers unique strengths that can transform my hotel’s operations and bottom line.

What Criteria Define the Largest Hotel Supply Companies in the Market?

Revenue alone doesn’t tell the whole story. Market dominance comes from multiple factors working together.

Hotel supply company size is measured by annual revenue, market share, product diversity, distribution network reach, and client base. Leading companies typically serve 10,000+ properties, offer 15,000+ SKUs, and maintain nationwide distribution centers with same-day delivery capabilities.

Key Performance Indicators That Matter

The hospitality supply industry operates differently from other B2B sectors. I’ve learned that size metrics go beyond simple revenue numbers.

Market Share and Revenue Streams

- American Hotel Register: Controls 12-15% market share

- Guest Supply: 8-10% market share through Sysco backing

- HD Supply: 6-8% focused on maintenance and operations

- DZEE Textiles: 4-5% specializing in textile manufacturing

- National Hospitality: 3-4% serving mid-market segment

Product Portfolio Breadth

The largest suppliers stock everything from guest room amenities to back-of-house equipment. American Hotel Register2 offers over 40,000 SKUs. This breadth lets hotels consolidate suppliers and reduce procurement complexity.

Distribution Network Strength

Physical presence matters in hospitality supply. Top companies operate 50+ distribution centers nationwide. Guest Supply leverages Sysco’s existing foodservice infrastructure. This network enables next-day delivery for urgent needs.

Client Relationship Depth

Large suppliers don’t just sell products. They provide inventory management systems, custom branding services, and procurement consulting. American Hotel Register manages inventory for major chains like Marriott and Hilton.

| Company | Market Share | SKU Count | Distribution Centers | Key Strength |

|---|---|---|---|---|

| American Hotel Register | 12-15% | 40,000+ | 60+ | Product diversity |

| Guest Supply | 8-10% | 25,000+ | 45+ | Amenity specialization |

| HD Supply | 6-8% | 35,000+ | 55+ | MRO focus |

| DZEE Textiles | 4-5% | 8,000+ | 12+ | US manufacturing |

| National Hospitality | 3-4% | 15,000+ | 25+ | Value pricing |

How Do Top Suppliers Compare in Size, Revenue, and Market Position?

Each major supplier carved out distinct market positions. Smart procurement means matching supplier strengths to my hotel’s needs.

American Hotel Register leads with $2.8 billion annual revenue, while Guest Supply generates $1.9 billion through Sysco’s distribution network. HD Supply focuses on maintenance supplies with $1.6 billion revenue, and DZEE Textiles specializes in US-manufactured textiles with $780 million revenue.

Revenue and Financial Stability Analysis

Financial strength directly impacts supply chain reliability. I need suppliers who can weather economic storms and maintain inventory levels.

American Hotel Register: The Comprehensive Giant

American Hotel Register dominates through sheer scale. Their $2.8 billion revenue comes from serving over 25,000 properties worldwide. They stock everything from guest amenities to kitchen equipment. Their financial stability means consistent pricing and reliable delivery.

The company’s strength lies in one-stop shopping. I can source guest room linens, bathroom amenities, housekeeping supplies, and maintenance equipment from a single vendor. This simplifies procurement and often leads to volume discounts.

Guest Supply: The Amenity Specialist

Guest Supply’s $1.9 billion revenue focuses heavily on guest amenities. As a Sysco subsidiary, they leverage massive distribution infrastructure. Their specialty is custom amenity programs for hotel chains.

What sets Guest Supply apart is their amenity customization. They handle everything from soap formulation to packaging design. Major chains like Marriott rely on Guest Supply for branded amenity programs.

HD Supply: The Operations Expert

HD Supply’s $1.6 billion revenue concentrates on maintenance, repair, and operations (MRO) supplies. They understand the operational side of hospitality better than anyone.

Their strength is technical expertise. HD Supply doesn’t just sell plumbing fixtures – they provide installation guidance and maintenance schedules. This knowledge helps me prevent costly emergency repairs.

Market Position and Competitive Advantages

Understanding each supplier’s market position helps me negotiate better terms and select the right partners.

Innovation and Technology Leadership

- American Hotel Register invests heavily in procurement technology

- Guest Supply leads in sustainable amenity development

- HD Supply offers predictive maintenance analytics

- DZEE Textiles focuses on rapid customization capabilities

- National Hospitality emphasizes cost optimization tools

Geographic Coverage Patterns

Market coverage varies significantly among suppliers. American Hotel Register maintains the broadest coverage with facilities in all 50 states. HD Supply focuses on major metropolitan areas. DZEE Textiles concentrates on regions with strong manufacturing presence.

Innovation drives market share growth in today’s competitive landscape. The suppliers adapting fastest to new trends gain competitive advantages.

Market leaders invest 3-5% of revenue in innovation, focusing on sustainability, automation, and customization technologies. Companies like Guest Supply increased market share by 15% through eco-friendly amenity lines, while DZEE Textiles grew 22% by offering 72-hour custom textile production.

Technology-Driven Market Disruption

The hotel supply industry is experiencing rapid technological change. Suppliers embracing innovation gain market share while traditional players lose ground.

Digital Procurement Platforms

American Hotel Register’s online platform processes over $500 million in annual orders. Their system integrates with hotel property management systems. This automation reduces procurement time by 40% and eliminates ordering errors.

The platform provides real-time inventory tracking and automated reordering. I can set minimum stock levels and let the system handle replenishment. This prevents stockouts while reducing carrying costs.

Sustainability Innovation Leadership

Guest Supply leads sustainability innovation with their eco-amenity line. They developed refillable amenity dispensers that reduce plastic waste by 80%. Major hotel chains adopted these systems to meet environmental commitments.

Their innovation extends to packaging. Guest Supply uses recycled materials and reduced packaging sizes. This cuts shipping costs while meeting sustainability goals.

Manufacturing Technology Advancement

DZEE Textiles invested $50 million in automated textile manufacturing. Their new systems produce custom linens in 72 hours versus industry standard 3-4 weeks. This speed advantage helps them win business from competitors.

Market share shifts reveal industry trends and supplier performance. Understanding these patterns helps me identify reliable long-term partners.

Consolidation Trends

The industry is consolidating rapidly. Sysco’s acquisition of Guest Supply created a supply chain giant. HD Supply merged with White Cap to expand market reach. These mergers create stronger suppliers but potentially reduce competition.

Emerging Market Segments

New market segments are emerging around specialized needs:

- Boutique hotel suppliers focusing on unique amenities

- Eco-friendly suppliers serving sustainability-focused properties

- Technology-enabled suppliers offering IoT integration

- Regional suppliers providing personalized service

Market leaders are acquiring companies in these segments to maintain dominance.

How Can You Select and Partner with These Companies Effectively?

Choosing the right supplier partner requires careful evaluation beyond just price comparison. The best partnerships create long-term value for both parties.

Effective supplier selection involves evaluating service quality, financial stability, innovation capacity, and cultural fit. Request client references, visit distribution facilities, and negotiate pilot programs before committing to long-term contracts. The most successful partnerships include quarterly business reviews and collaborative cost reduction initiatives.

Strategic Supplier Evaluation Framework

My approach to supplier selection has evolved from price-focused to value-focused. The cheapest supplier often costs more in the long run through service failures and quality issues.

Financial Health Assessment

I always review supplier financial statements before major commitments. Dun & Bradstreet reports reveal payment patterns and credit ratings. Strong suppliers maintain current ratios above 2.0 and debt-to-equity ratios below 0.5.

American Hotel Register’s strong balance sheet provides supply chain security. Their $2.8 billion revenue and low debt levels ensure they can maintain inventory during economic downturns.

Service Capability Evaluation

Service capabilities matter more than product catalogs. I evaluate suppliers on delivery reliability, order accuracy, and problem resolution speed.

HD Supply excels in emergency service. Their 24/7 customer service and same-day delivery capability have saved me thousands in crisis situations. When our HVAC system failed during peak season, HD Supply delivered replacement parts within 4 hours.

Technology Integration Assessment

Modern suppliers must integrate with hotel technology systems. I test API compatibility with property management systems and accounting software.

Guest Supply’s system integrates seamlessly with major PMS platforms. Orders automatically populate from inventory management systems. This integration reduces manual work and prevents ordering errors.

Partnership Development Best Practices

Strong supplier partnerships require ongoing management and communication. I’ve learned that successful relationships go beyond transactional interactions.

Pilot Program Implementation

I always start with pilot programs before full commitments. This lets me test service quality and product performance without major risk.

With DZEE Textiles, I piloted their custom linen program in two properties. The 72-hour turnaround impressed guests and staff. Quality exceeded expectations, leading to a full contract.

Performance Metrics and Reviews

Quarterly business reviews keep partnerships on track. I track metrics like:

- On-time delivery percentage

- Order accuracy rates

- Cost per unit trends

- Quality complaint frequencies

- Innovation project progress

These metrics provide objective partnership evaluation and improvement opportunities.

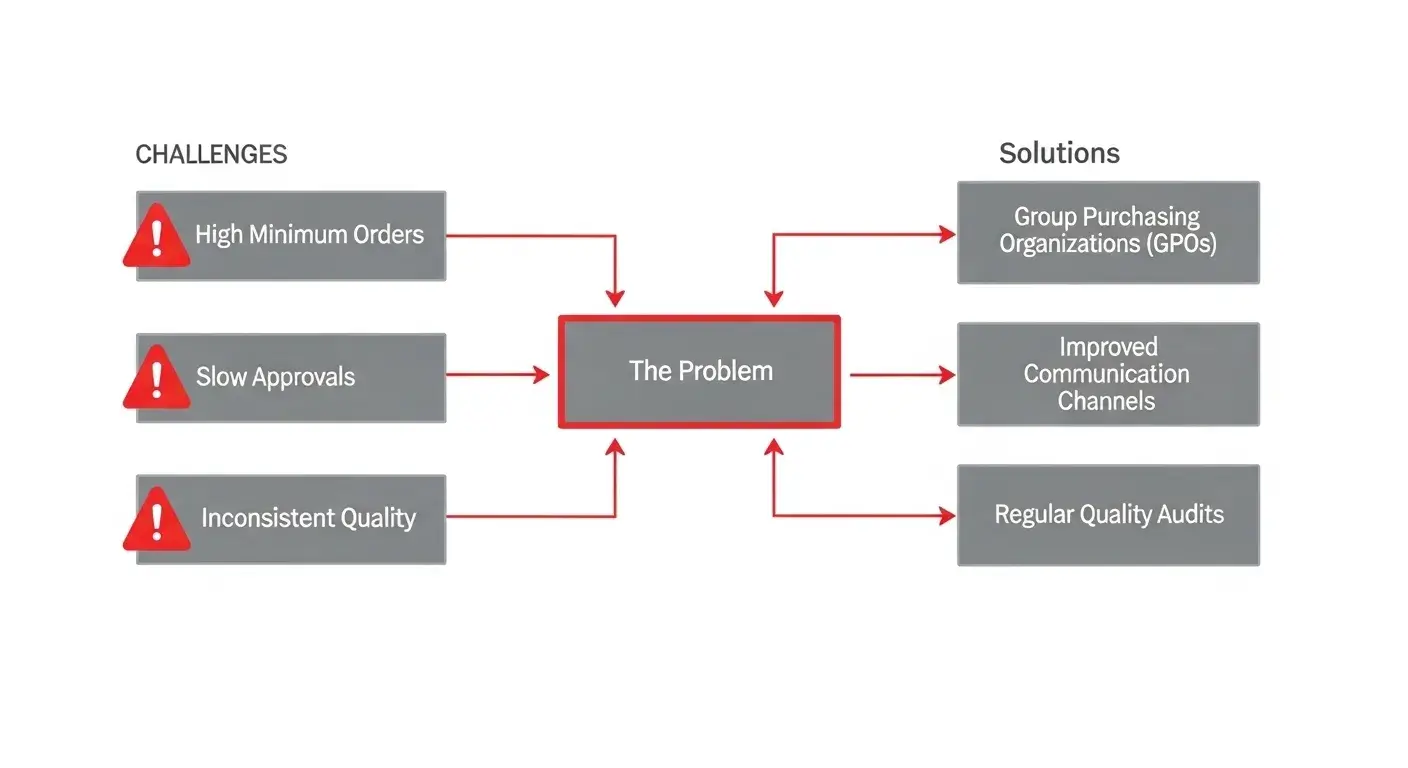

What Common Challenges Exist When Working with Large Suppliers?

Size brings advantages but also creates unique challenges. Understanding these issues helps me navigate supplier relationships more effectively.

Large suppliers commonly impose high minimum order quantities, longer lead times for custom products, and less flexible pricing terms. However, they offset these challenges through superior inventory management systems, broader product selection, and stronger financial stability during supply chain disruptions.

Scale-Related Operational Challenges

Working with large suppliers requires different management approaches than smaller vendors. Their size creates both opportunities and obstacles.

Minimum Order Quantity Constraints

Large suppliers often impose high MOQs that don’t align with small hotel needs. American Hotel Register requires $2,500 minimum orders. For a 50-room property, this might represent 6 months of inventory.

I solve this by joining group purchasing organizations. GPOs aggregate demand from multiple properties to meet MOQs. This approach provides large supplier benefits at small hotel scale.

Service Personalization Limitations

Large suppliers struggle with personalized service. Account managers handle 200+ accounts and may not understand individual property needs.

The solution is establishing clear communication protocols. I schedule monthly calls with account managers and document specific requirements. This creates accountability and improves service quality.

Bureaucratic Decision Making

Large organizations move slowly on custom requests and pricing negotiations. HD Supply’s approval process for custom products takes 4-6 weeks versus 1-2 weeks for smaller suppliers.

I plan custom projects well in advance and maintain relationships with multiple suppliers. This gives me flexibility when timing is critical.

Quality Control and Consistency Issues

Large suppliers face quality control challenges across diverse product lines and manufacturing partners. Understanding these risks helps me mitigate problems.

Product Quality Variability

When sourcing from multiple manufacturers, large suppliers sometimes experience quality inconsistencies. Guest Supply sources amenities from 50+ manufacturers worldwide. Quality can vary between production runs.

I address this by requesting samples from each production batch and establishing clear quality specifications in contracts. Regular quality audits ensure standards are maintained.

Communication Breakdowns

Large organizations suffer communication gaps between sales, operations, and customer service teams. Orders get lost or delayed due to internal coordination failures.

My solution is maintaining contact with multiple departments. I have direct numbers for account managers, customer service, and logistics coordinators. This ensures issues get resolved quickly.

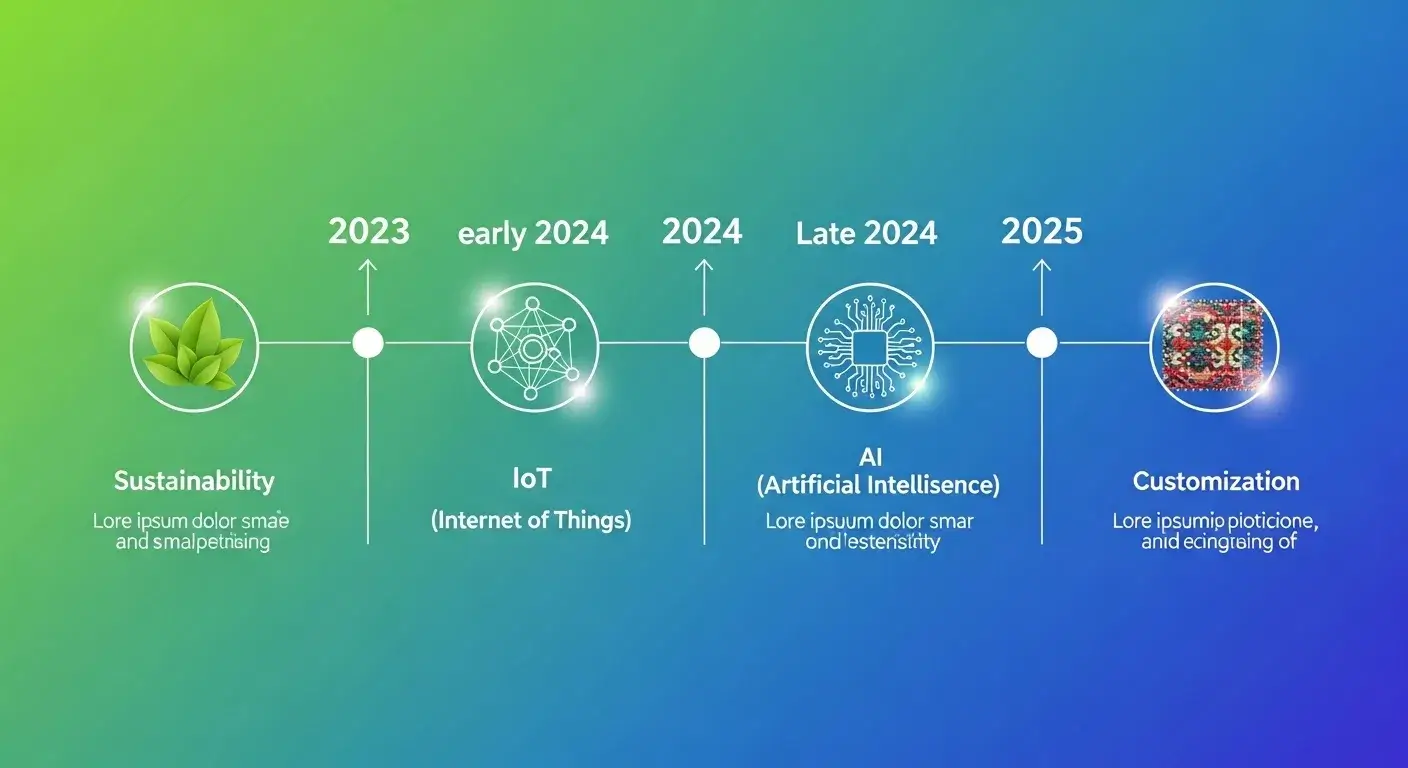

How Are Emerging Trends Influencing the Hotel Supply Landscape?

The industry is transforming rapidly through sustainability demands, technology integration, and changing guest expectations. Smart suppliers are adapting while others struggle.

Key trends reshaping hotel supply include sustainability mandates3 driving 40% growth in eco-friendly products, IoT integration enabling predictive maintenance, and customization technologies reducing lead times from weeks to days. Suppliers investing in these areas are gaining market share while traditional vendors lose ground.

Sustainability Revolution Impact

Environmental consciousness is reshaping supplier strategies and product development. Hotels demand sustainable options to meet guest expectations and regulatory requirements.

Eco-Friendly Product Development

Guest Supply leads with amenities containing 75% recycled content. Their refillable dispenser systems reduce plastic waste by 80%. Major chains like Marriott and Hyatt mandate these systems in new properties.

The sustainability trend extends beyond amenities. DZEE Textiles uses organic cotton and low-impact dyes in their linen production. These products cost 15-20% more but meet growing demand for environmental responsibility.

Circular Economy Initiatives

Progressive suppliers are developing take-back programs for used products. American Hotel Register accepts old linens for recycling into new products. This closed-loop approach reduces waste and lowers costs.

HD Supply offers equipment refurbishment programs. They collect old maintenance equipment, refurbish it to like-new condition, and sell it at 40% discounts. This program reduces environmental impact while providing cost savings.

Technology Integration Acceleration

Digital transformation is creating new supplier capabilities and business models. The most successful suppliers are becoming technology companies that happen to sell hotel supplies.

IoT and Predictive Analytics

HD Supply’s IoT sensors monitor equipment performance and predict failures before they occur. This technology prevents costly emergency repairs and extends equipment life.

Their system tracks usage patterns and automatically orders replacement parts. A hotel’s HVAC filters are replaced based on actual usage rather than arbitrary schedules. This optimization reduces costs while improving air quality.

Artificial Intelligence Applications

American Hotel Register uses AI for demand forecasting and inventory optimization. Their system analyzes booking patterns, seasonal trends, and local events to predict supply needs.

This technology reduces stockouts by 60% while cutting inventory costs by 25%. Hotels receive products exactly when needed without excess inventory carrying costs.

Customization Technology Evolution

Guest expectations for personalized experiences drive demand for customized products. Suppliers investing in rapid customization capabilities gain competitive advantages.

Digital Printing and Manufacturing

DZEE Textiles’ digital printing technology produces custom linens in 72 hours. Traditional screen printing required 3-4 weeks and high minimum orders. Digital printing enables small batches with quick turnaround.

This capability helps boutique hotels create unique guest experiences. Custom linens featuring local artwork or hotel branding enhance property identity and guest satisfaction.

Mass Customization Platforms

Guest Supply’s online customization platform lets hotels design branded amenities. The system provides real-time pricing and delivery estimates for custom products.

Hotels can upload logos, select fragrances, and choose packaging options. The system automatically generates production specifications and routing for manufacturing partners.

Conclusion

The largest US hotel supply companies offer distinct advantages through scale, innovation, and specialized expertise, enabling smarter procurement decisions that boost profitability.

-

Hotel expenses analysis showing procurement costs typically represent 20-30% of revenue, with supply costs being a major portion of ongoing operational expenses. ↩

-

Comprehensive overview of American Hotel Register Company’s history, from its founding in 1865 as a publisher to becoming a major hospitality supply manufacturer and distributor. ↩

-

Industry statistics showing growing sustainability adoption in hotels, with data on certification increases and environmental initiatives driving market changes. ↩